Irs Schedule C Instructions 2024

1 min readIrs Schedule C Instructions 2024 – That said, we all want to move up in our tax brackets, and paying more taxes isn’t always a bad thing. In 2024 (for the 2025 return), the seven federal tax brackets persist: 10%, 12% . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .

Irs Schedule C Instructions 2024

Source : www.acawise.com

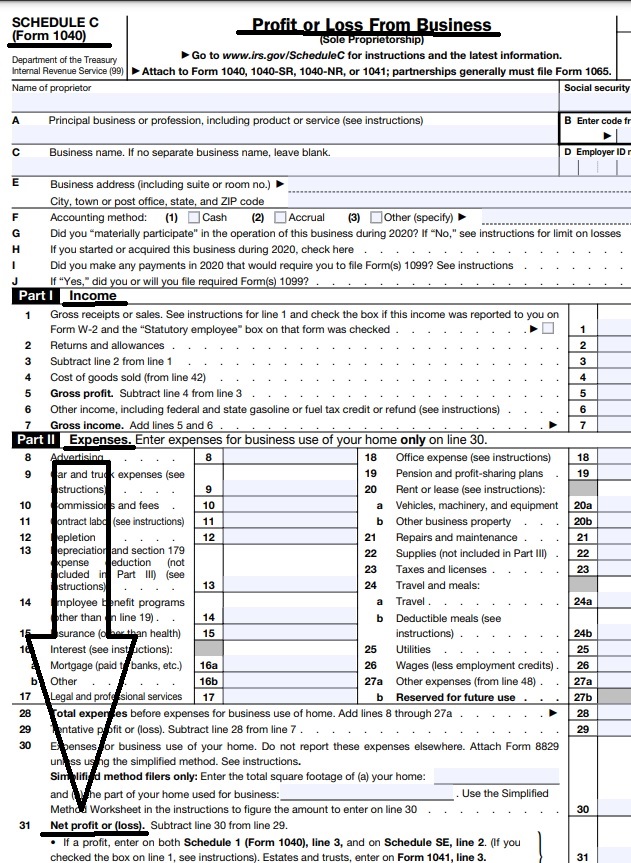

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

Schedule C (Form 1040) 2023 Instructions

Source : lili.co

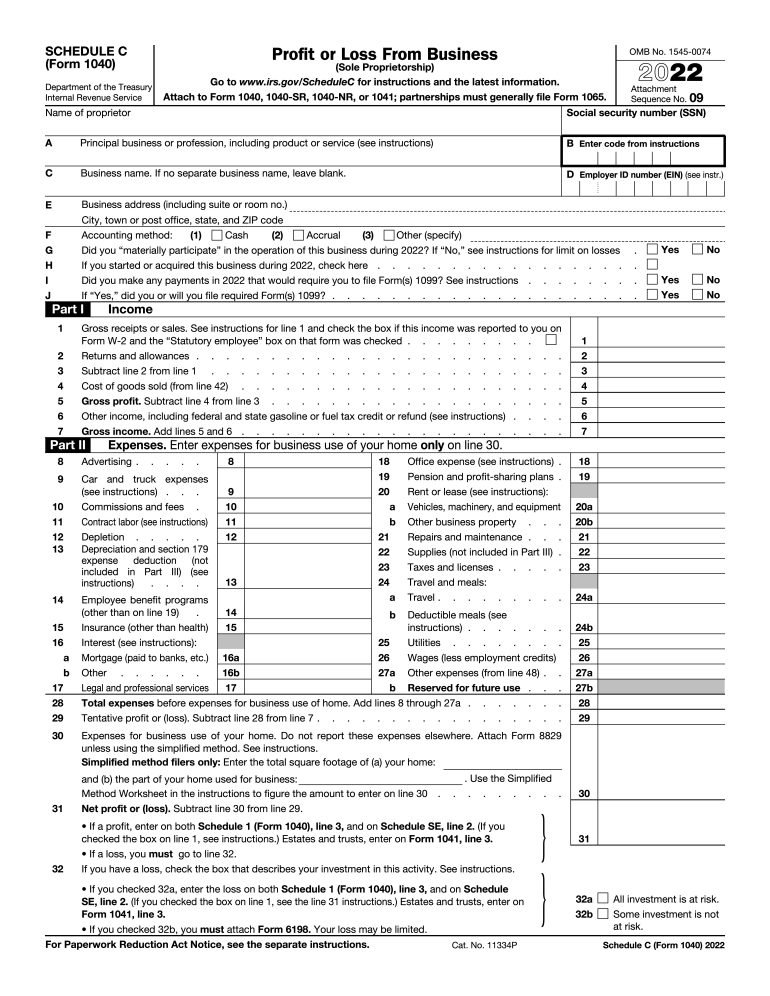

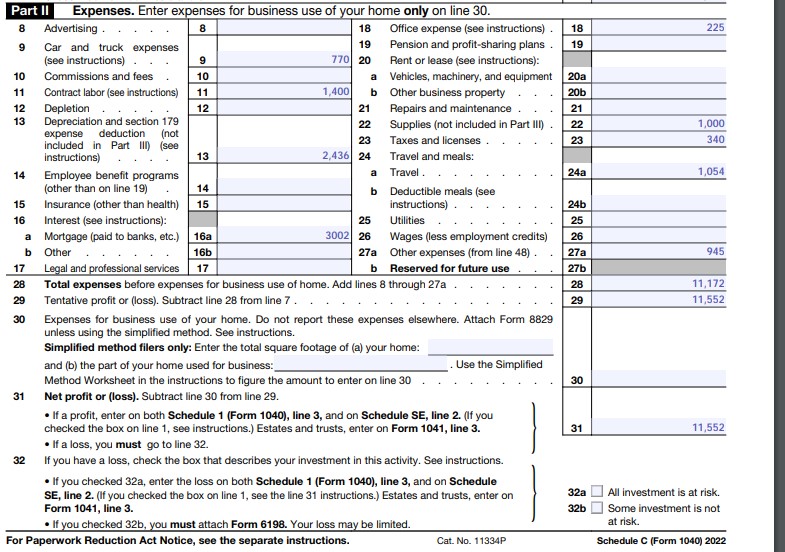

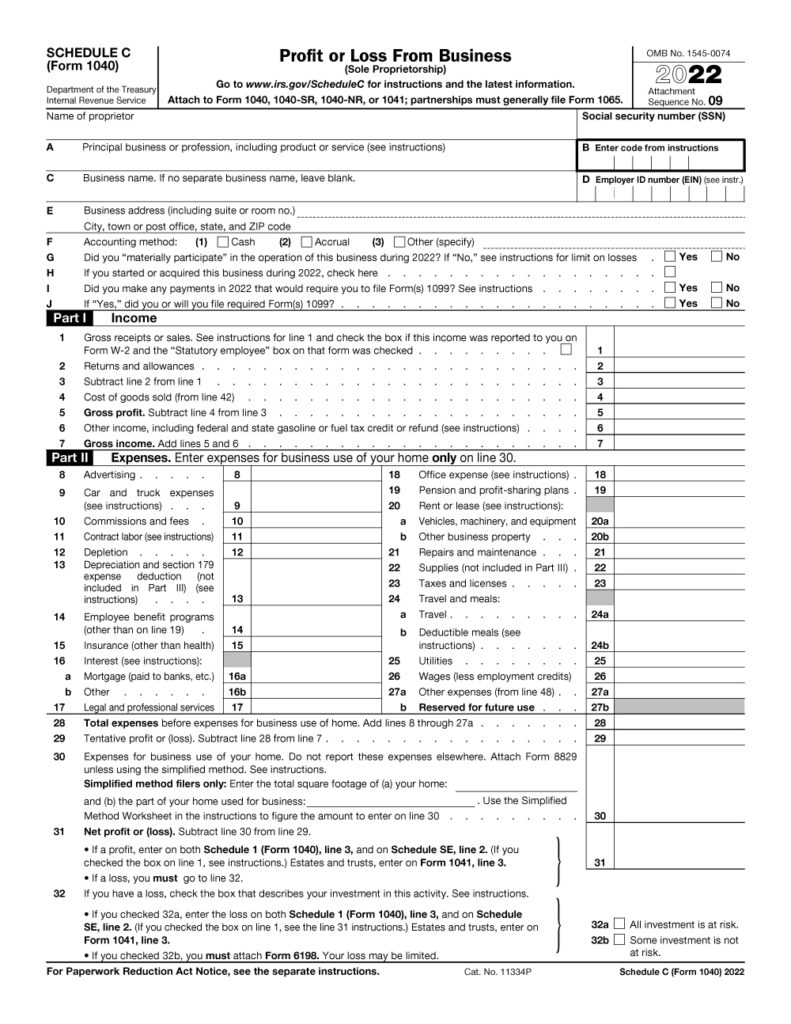

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Schedule C (Form 1040) 2023 Instructions

Source : lili.co

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Schedule C 1040 line 31 Self employed tax MAGI instructions home

Source : individuals.healthreformquotes.com

Schedule C (Form 1040) 2023 Instructions

Source : lili.co

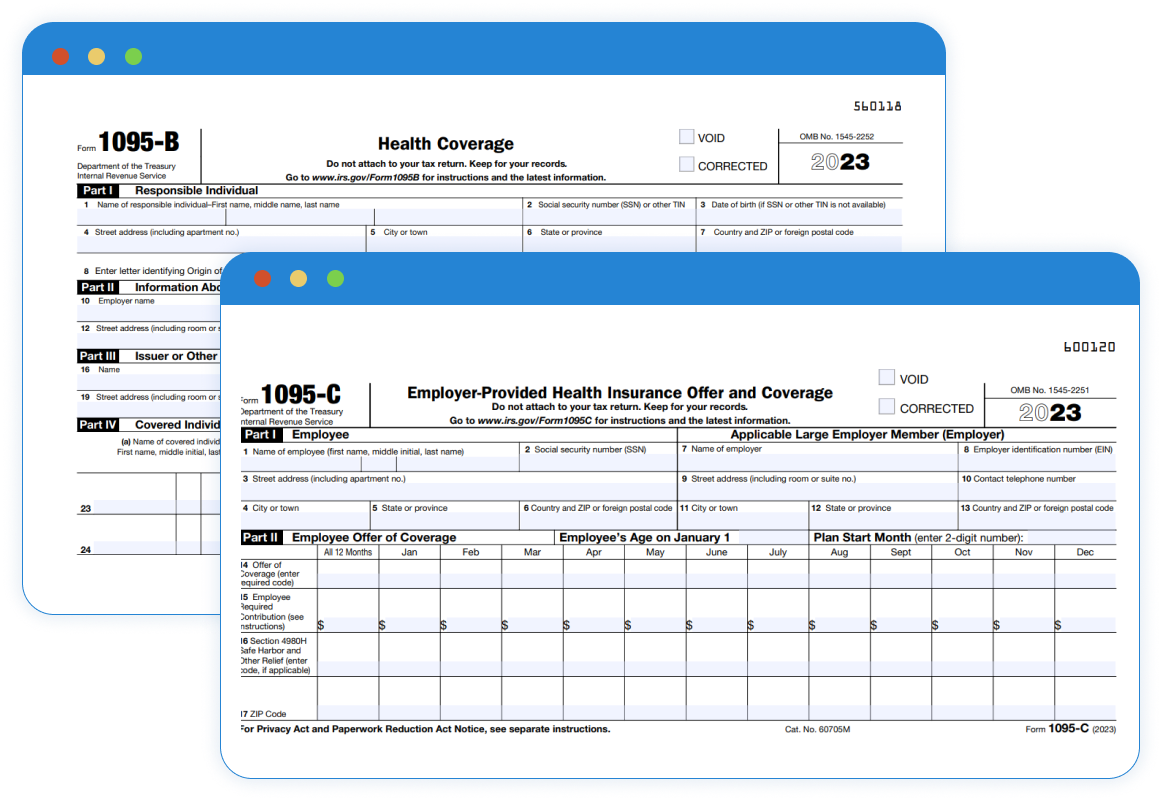

Irs Schedule C Instructions 2024 The IRS Releases Final Version of Form 1095 B & 1095 C for 2023 : In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Get your tax years straight Tax years can get confusing. . The IRS has announced new income tax brackets for 2024. The IRS issued a press release describing the 2024 tax year adjustments that will apply to income tax returns filed in 2025. Standard deduction .